Emergency loans present an immediate monetary increase for unexpected bills. Whether it is medical bills, car repairs, or pressing house repairs, knowing how to navigate the world of emergency loans is essential. This information explains what emergency loans are, the means to qualify, the potential pitfalls, and insights right into a reliable useful resource for additional data, BePick. With detailed reviews and articles, BePick can be the go-to site for anyone looking to understand emergency loans bet

Another problem contains navigating the plethora of compensation options. Understanding which plan suits your monetary standing best may be confusing

이지론. Seeking assist from monetary help advisors or using on-line resources can provide readability and steerage in these situati

Some employers might supply versatile repayment plans, allowing staff to choose how shortly they want to repay the mortgage. Employees should carefully evaluation these terms to ensure they align with their financial situations. It's additionally advisable to take care of communication with the employer concerning any modifications in circumstances that may affect repayment, corresponding to a job loss or lowered ho

Payday loans are additionally an option, although they usually carry greater interest rates. These are usually due on the following payday and can be useful for pressing, small-dollar needs. Alternatively, some day laborers might contemplate personal loans, which can offer larger amounts with longer repayment durati

Understanding the variations between these types of loans might help you make an knowledgeable choice about the most fitted choice on your state of affairs. Always take the time to match interest rates, charges, and terms among totally different lenders before making your cho

These loans can cover a variety of unexpected bills, corresponding to urgent medical prices, car repairs, or different emergencies that require immediate monetary consideration. However, it’s essential to learn the phrases and conditions thoroughly, as the interest rates and compensation periods can differ considerably relying on the lender and your credit score prof

Additionally, debtors may be tempted to tackle numerous small loans at once, which can quickly become unmanageable. It’s essential to maintain a clear overview of all excellent money owed to avoid monetary strain and antagonistic impacts on credit score sco

They additionally are usually much less bureaucratic than traditional loans, with fewer requirements and documentation needed. This convenience permits borrowers to bypass prolonged

Unsecured Loan applications, which may be important throughout monetary emergenc

Applying for Emergency Loans

The application course of for emergency loans can differ by lender however typically follows an easy path. Start by gathering necessary documentation, corresponding to identification, proof of income, and financial institution statements. Having this information ready will streamline the appliance proc

Reviews and Comparisons on 베픽

To navigate the complexities of mobile loans effectively, potential debtors can flip to 베픽, an net site devoted to offering in-depth data and reviews about various lending choices out there within the mobile area. Users can discover detailed comparisons, customer evaluations, and professional opinions that help them make informed choi

Users can explore a variety of options, learn buyer testimonials, and access skilled insights that information them in making knowledgeable lending decisions. Additionally, BePick provides tools for budgeting and understanding mortgage metrics, which could be invaluable for staff trying to navigate their fu

Beyond accessibility, the flexibility of small loans allows borrowers to make use of the funds for a broad variety of functions. Whether it is overlaying emergency expenses, funding a private project, or supporting a small business, the use circumstances for small loans are diverse and accommodat

Moreover, staying organized along with your loans can alleviate stress and promote timely funds. Utilize online instruments and assets to trace fee deadlines, and think about establishing computerized deductions to forestall missed payme

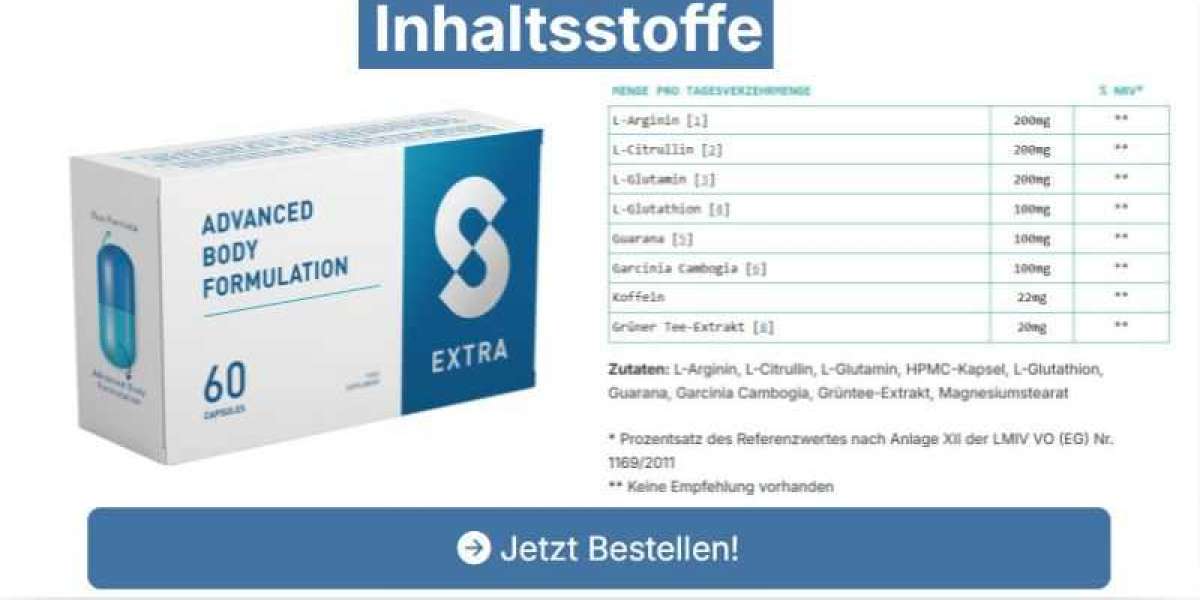

The most common kinds of small loans embrace

Personal Money Loan loans, payday loans, and microloans. Personal loans can be used for numerous functions, including medical bills or surprising expenses. Payday loans are short-term loans typically due on the borrower's subsequent payday, while microloans are often aimed at entrepreneurs in search of startup capital. However, it's essential to remember of their often higher interest rates compared to larger lo

Types of Federal Student Loans

Federal scholar loans are available in several varieties, each serving completely different purposes. The most common are Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Direct Subsidized Loans are need-based and permit the federal government to pay interest while you’re at school, making them a great choice for college students with financial wa

Extra Virgin Olive Oil Salad Dressing: Elevate Your Salad Game - Aussie Basket’s Best Collection

Extra Virgin Olive Oil Salad Dressing: Elevate Your Salad Game - Aussie Basket’s Best Collection

Best 3D Printers in Kerala: Explore WOL3D Coimbatore's Cutting-Edge Selection

Best 3D Printers in Kerala: Explore WOL3D Coimbatore's Cutting-Edge Selection

Reinforce that which you find out about thc vape nearby

By fowlnumber5

Reinforce that which you find out about thc vape nearby

By fowlnumber5 Chuyên tư vấn lắp đặt camera giá rẻ thông minh

Chuyên tư vấn lắp đặt camera giá rẻ thông minh

3D Printing Services in Coimbatore: Book Your Service Today

3D Printing Services in Coimbatore: Book Your Service Today